Singapore is the global leader in cultivated meat, becoming the first country to approve its commercial sale in 2020. This leadership stems from three key factors:

- Efficient Regulatory Process: Singapore’s Food Agency (SFA) reviews applications in 9–12 months, far faster than countries like the US or EU.

- Government Investment: Over £180 million has been allocated to alternative proteins, creating infrastructure like bioreactor-equipped innovation centres.

- Food Security Goals: The "30 by 30" initiative aims to produce 30% of Singapore’s nutritional needs locally by 2030, reducing reliance on imports.

These efforts have enabled companies like GOOD Meat, Vow, and Parima to launch cultivated meat products in Singapore, while regulatory clarity and funding continue to attract global innovators.

Singapore's First Approval of Cultivated Meat

How the Singapore Food Agency Approved Cultivated Meat

On 1 December 2020, the Singapore Food Agency (SFA) made history by granting the world's first approval for cultivated meat. This landmark decision went to Eat Just, a company based in California, for its cultivated chicken bites. The approval came after the SFA conducted a detailed and rigorous safety assessment of the company's cell-culturing process.

To secure approval, Eat Just had to provide a comprehensive dossier detailing its raw materials, production methods, and safety measures. A key requirement was demonstrating batch consistency - showing reproducibility at a commercial scale by submitting data from at least three non-consecutive production batches. This ensured the product could be reliably produced while maintaining high standards. The approval not only marked a milestone for Eat Just but also opened the door for future advancements in the cultivated meat sector.

Following this approval, Eat Just, operating under its GOOD Meat brand, introduced its cultivated chicken at the 1880 restaurant in Singapore, making it the first restaurant globally to serve cultivated meat. By May 2024, this regulatory green light also made it possible for cultivated meat to be sold in retail outlets across Singapore.

What Makes Singapore's Regulatory Process Different

Singapore's regulatory framework stands out for its efficiency and adaptability, ensuring safety without unnecessary delays. The SFA laid the groundwork for this process in November 2019 with its "Requirements for the Safety Assessment of Novel Foods and Novel Food Ingredients", providing a clear and structured pathway for companies seeking approval.

"There is no one-size-fits-all approach to the testing of novel foods." – Singapore Food Agency

This statement reflects the SFA's flexible yet scientifically rigorous approach, allowing each application to be assessed on its unique merits. The application process includes a fee of £1,300 ($1,750), with evaluations typically taking 9 to 12 months after the fee is acknowledged. Compared to other major markets, such as the United States or Australia, this timeline is significantly shorter - often taking half or even a third of the time.

The SFA also offers hands-on support through initiatives like the Future Ready Food Safety Hub (FRESH) and Novel Food Virtual Clinics. These resources guide companies in preparing their safety dossiers, helping them meet regulatory standards from the outset. This proactive approach minimises delays and ensures smoother submissions, making Singapore an attractive hub for food innovation.

Food Security: Why Singapore Prioritises Cultivated Meat

Singapore's Food Security Challenges

Singapore's dependence on food imports makes it particularly vulnerable to global supply disruptions. With limited arable land and a dense population, traditional farming methods simply cannot meet the country's needs. Damian Chan, Executive Vice President of the Singapore Economic Development Board, highlights the issue:

"As a resource-constrained urban city-state, global concerns on food resilience are more critical for us. However, advancements in technology are rapidly changing the resources required to increase production efficiency - we can now hope to produce more with less." [4]

This is where Cultivated Meat comes into play. It offers a way to produce food without the need for large amounts of land and water, making it a practical solution for Singapore's unique challenges [1]. These limitations are a driving force behind the nation's focus on boosting domestic food production through innovative methods like Cultivated Meat.

The '30 by 30' Vision and Alternative Proteins

To tackle these challenges head-on, Singapore introduced its '30 by 30' vision in 2019. The goal? To produce 30% of the country's nutritional needs locally by 2030 [3]. This strategy hinges on diversifying food sources, increasing local production, and helping homegrown businesses expand internationally. Cultivated Meat is a cornerstone of this plan.

The government has thrown its weight behind this initiative, with substantial funding to back it up. For instance, S$144 million has been allocated to the Singapore Food Story R&D Programme, which supports sustainable urban food production and biotech-based protein development. Investments in alternative proteins have skyrocketed, jumping from US$5.9 million in 2019 to US$169.8 million by 2022. Today, Singapore is home to over 60 alternative protein companies, employing around 790 people [3].

Government Funding for Alternative Proteins

Singapore's commitment to food security goes beyond just vision statements. The government has allocated approximately $230 million (about £177 million) to alternative protein development. This funding supports grants, researcher training, and specific R&D projects, with S$42 million set aside for research alone [1].

This financial backing has led to the creation of key facilities. In April 2024, state-backed Nurasa opened a food innovation centre equipped with 100-litre bioreactors and cutting-edge tools to scale up production. Similarly, in April 2022, the Singapore Institute of Technology, Enterprise Singapore, and JTC Corporation launched FoodPlant, the country's first shared facility for small-batch food production, licensed by the Singapore Food Agency [2].

Mirte Gosker, Managing Director of the Good Food Institute Asia Pacific, underscores the importance of such investments:

"The biggest obstacle to cultivated meat reaching the masses … is the broad underinvestment in R&D and manufacturing infrastructure, especially from governments." [1]

Cultivated Meat Companies Operating in Singapore

Approved Companies and Products

Singapore's forward-thinking regulatory framework has opened doors for a variety of companies to introduce cutting-edge cultivated meat products. GOOD Meat, a division of Eat Just, made history in December 2020 by becoming the first to gain approval for its cultivated chicken. By May 2024, the company launched the world’s first retail sale of cultivated meat at Huber’s Butchery. This product, consisting of 3% cultivated cells and 97% plant-based ingredients, was designed to balance innovation with scalability [5].

In April 2024, Australian company Vow earned approval for its cultivated quail product, marketed under the Forged brand. Its "Forged Parfait" was unveiled at the Mandala Club’s MORI restaurant in Singapore, showcasing a unique take on cultivated meat [16,17].

French startup Parima (previously known as Gourmey and Vital Meat) became the first European company to secure approval for human consumption in October 2025. Reflecting on this milestone, CEO Nicolas Morin-Forest remarked, "This approval is a testament to our approach. It validates the safety and robustness of the core foundation of our multi-species platform" [7]. Parima has since hosted public tastings at Hue restaurant to introduce its products [17,20].

In a different segment, Friends & Family Pet Food Co gained approval in June 2025 for cultivated poultry specifically for pet food, marking Asia’s first regulatory clearance in this niche. The company plans to launch eight products in autumn 2025, featuring "Kampung bird" poultry, which makes up 60–65% of the product by volume. CEO Joshua Errett shared, "Part of the Friends & Family mission is not simply to replace the protein in the pet food supply chain, but to improve the underlying protein cats and dogs eat" [6].

These advancements highlight Singapore’s growing role in shaping the future of cultivated meat, with seafood innovations also on the horizon.

Cultivated Seafood Developments

While no cultivated seafood product has yet received full commercial approval for human consumption, Singapore is positioning itself as a hub for this emerging sector. UMAMI Bioworks, for instance, has teamed up with Friends & Family to develop cultivated fish for pet food. The company has even relocated its main operations to Singapore to take advantage of government R&D funding [18,19]. CEO Mihir Pershad emphasised the importance of collaboration, saying, "Shared developmental resources like this can help solve specific problems in the value chain and bottlenecks that many companies share" [1].

Global players such as Bluu Seafood from Germany and Avant Meats from China are also engaging with the Singapore Food Agency, aiming for future approvals [5]. The focus is shifting to high-value species like crab, shrimp, and lobster - key staples in Asian cuisine. These efforts not only meet regional demand but also address the environmental concerns tied to industrial fishing.

With 174 companies worldwide working on cultivated meat, Singapore’s infrastructure and regulatory environment provide a strong foundation for seafood innovation. Facilities like the Nurasa Food Innovation Centre, equipped with 100-litre bioreactors, exemplify the city-state’s commitment to supporting this growing industry [3,16].

sbb-itb-c323ed3

Lab-grown meat: Why are countries banning it? - The Global Story podcast, BBC World Service

Singapore vs. Other Markets: Key Differences

Singapore vs Global Markets: Cultivated Meat Approval Timelines and Regulatory Frameworks

Approval Timelines Compared

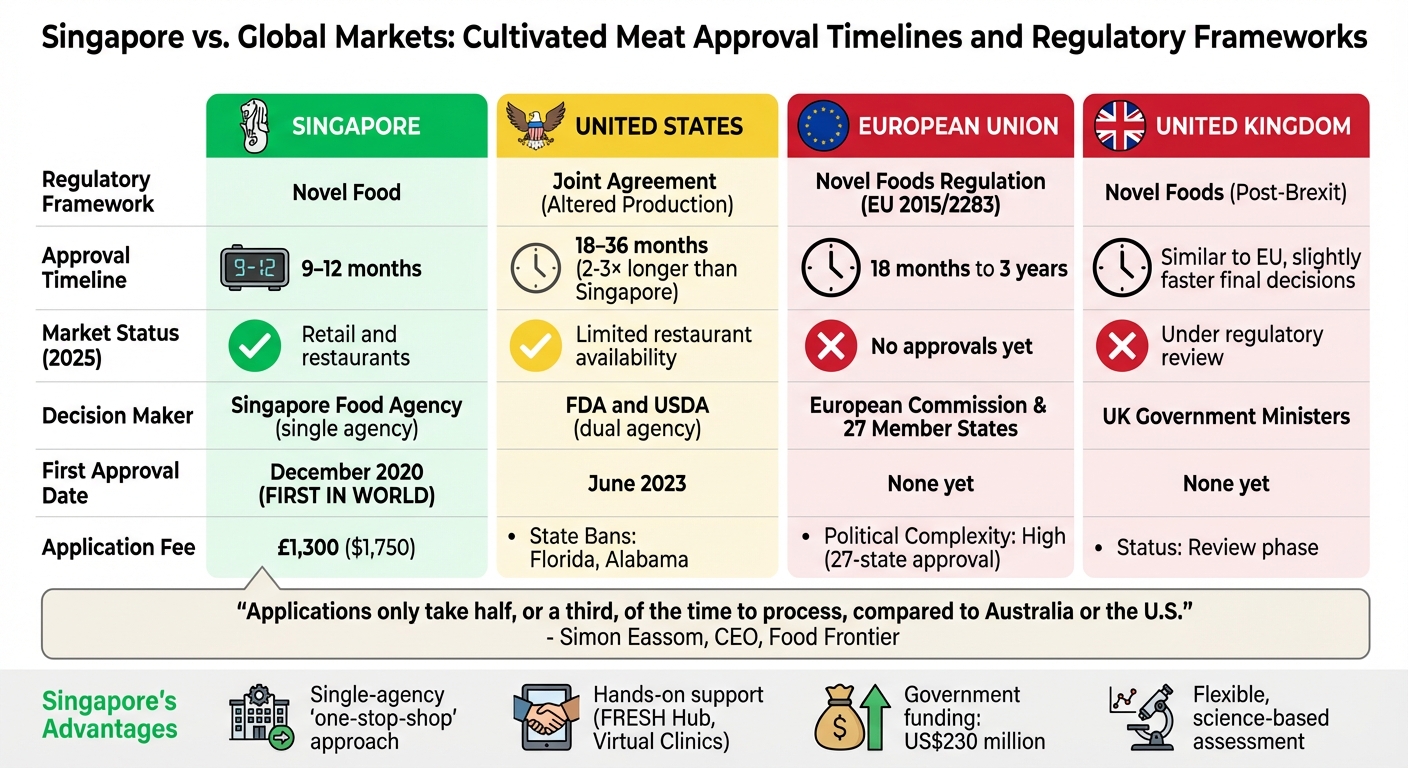

Singapore stands out for its swift regulatory process in approving Cultivated Meat. The Singapore Food Agency (SFA) typically reviews applications within 9–12 months [8]. In comparison, the United States takes two to three times longer [1], while the European Union's timeline stretches to 18 months or even up to 3 years. The UK follows a similar pattern to the EU, though its final decisions may come slightly quicker.

Singapore made history in December 2020 as the first country to approve Cultivated Meat. The US followed in June 2023, with Israel joining the list in January 2024. Meanwhile, the EU and UK are yet to green-light any commercial products.

"Applications only take half, or a third, of the time to process, compared to Australia or the U.S." – Simon Eassom, CEO, Food Frontier [1]

Singapore's regulatory framework benefits from its single-agency approach, acting as a "one‑stop‑shop" for approvals. In contrast, the US splits responsibilities between the FDA, which oversees cell collection and growth, and the USDA, which handles harvesting and labelling. The EU's process involves an additional layer of complexity, requiring approval from a committee representing all 27 member states, often leading to political delays.

| Region | Regulatory Framework | Approval Timeline | Market Status (2025) | Decision Maker |

|---|---|---|---|---|

| Singapore | Novel Food | 9–12 months | Retail and restaurants | Singapore Food Agency |

| United States | Joint Agreement (Altered Production) | 2–3× longer than Singapore | Limited restaurant availability | FDA and USDA |

| European Union | Novel Foods Regulation (EU 2015/2283) | 18 months to 3 years | No approvals | European Commission & 27 Member States |

| United Kingdom | Novel Foods (Post‑Brexit) | Similar to the EU, with faster final decisions | Under regulatory review | UK Government Ministers |

Singapore's streamlined system highlights the stark contrast with slower, multi-agency frameworks elsewhere, underscoring its leadership in this space.

Why Other Regions Have Been Slower to Approve

The differences in approval timelines are just the tip of the iceberg. Variations in regulatory frameworks and political influences further explain the delays in other regions. Singapore evaluates Cultivated Meat as a Novel Food, assessing each product individually with a flexible and tailored approach [6,22]. Meanwhile, the US classifies it as an altered production method of existing meat products, which introduces additional complexity [6,23].

Politics also play a significant role. In early 2024, Singapore's Islamic Religious Council declared Cultivated Meat halal, significantly expanding its market potential. On the other hand, some US states like Florida and Alabama have outright banned the technology, while Italy has introduced similar restrictions to safeguard its agricultural traditions [3,7]. Singapore's proactive government support, including approximately S$230 million in funding for alternative protein research [1], has created a favourable environment that other regions have struggled to replicate.

In the UK, post-Brexit regulatory changes allow decisions to rest with UK ministers rather than a multinational committee. However, the country remains in the review phase, with no commercial approvals to date.

Singapore’s success lies in its ability to balance scientific rigour with procedural flexibility. Its regulatory body works closely with startups, offering individual consultations to refine safety dossiers. This collaborative and efficient approach has cemented Singapore's position as the global leader in Cultivated Meat approvals.

Conclusion

Singapore has positioned itself as a trailblazer in the cultivated meat industry, becoming the first country to commercialise it [2]. This leadership is rooted in a combination of necessity and forward-thinking regulatory strategies. By prioritising swift approvals, securing robust funding of US$230 million, and fostering collaboration between the Singapore Food Agency and innovators, the nation has built a thriving ecosystem [1].

The push for innovation is further driven by Singapore's food security challenges. With the '30 by 30' vision, which aims to produce 30% of the country's nutritional needs locally by 2030, alternative proteins have become a critical focus. Given Singapore's heavy reliance on imports, the urgency to diversify food sources has led to regulatory processes that are significantly faster - taking only half to one-third of the time required in countries like the US or Australia [1].

"Singapore's forward-thinking moves on alternative proteins have also had another, perhaps unintended, effect: they guaranteed that The Lion City would serve as the de facto model for how other countries accelerate and regulate novel foods." – Ryan Huling, Senior Communications Manager, GFI APAC [4]

Investment in the sector has skyrocketed, climbing from US$5.9 million in 2019 to an impressive US$169.8 million by 2022 [3]. Over 60 companies are now actively engaged in this space. Milestones like Eat Just's retail launch at Huber's Butchery in May 2024 and Vow's approval for cultivated quail highlight Singapore's role in shaping the global landscape.

This leadership is resonating far beyond its borders. Singapore's regulatory framework is now seen as a model for improving food security and driving innovation globally. With the alternative protein market projected to reach US$290 billion by 2035 [3], Singapore's early efforts have not only established it as a testing ground but also as a roadmap for the future of sustainable meat production.

For those eager to dive deeper into this transformative food category, Cultivated Meat Shop offers a wealth of resources to explore how cultivated meat is revolutionising the way we think about food.

FAQs

Why is Singapore a global leader in cultivated meat regulation?

Singapore has cemented its position as a trailblazer in the cultivated meat sector, thanks to its efficient and streamlined regulatory framework. The Singapore Food Agency (SFA) plays a pivotal role by acting as the sole authority responsible for evaluating and approving novel food products like cultivated meat. Back in December 2020, Singapore made history as the first country to greenlight a cultivated meat product for commercial sale, setting a global standard with its thorough safety checks and clear labelling requirements.

This progressive stance is bolstered by initiatives such as the government-supported “30 by 30” programme, which focuses on boosting food security and encouraging innovation. Unlike countries where regulatory systems are either fragmented or overly restrictive, Singapore’s unified, science-driven approach allows for quicker approvals and easier market entry. This unique framework has positioned Singapore as a leader in this rapidly evolving industry.

How has government investment helped Singapore become a leader in cultivated meat?

Singapore's rise as a global leader in cultivated meat owes much to strategic government investment. Back in 2020, the government committed S$144 million through the Singapore Food Story R&D Programme to boost research in alternative proteins. This funding aligns with the country's ambitious “30 by 30” vision, aiming to meet 30% of its nutritional needs locally by 2030. The result? A wave of innovation and an increase in local production capacity.

Fast forward to 2022, and investment in Singapore's alternative protein sector had soared to US$169.8 million, a dramatic leap from just US$5.9 million in 2019. This influx of funding has done more than just fuel innovation - it’s attracted global startups, nurtured early-stage ventures, and provided the regulatory framework for companies to develop and bring cultivated meat products to market. Today, Singapore boasts a thriving ecosystem with over 60 cultivated meat companies, solidifying its position as a key player in this rapidly growing industry.

How does cultivated meat support Singapore's food security goals?

Cultivated meat is becoming a key player in Singapore's strategy to bolster its food security. With over 90% of its food supply imported and less than 1% of its land available for agriculture, the nation faces significant risks from supply chain disruptions, geopolitical tensions, and price spikes. By developing cultivated meat locally, Singapore can cut down its dependence on imports and expand its protein options. This directly supports the country’s ambitious “30 by 30” initiative, which aims to produce 30% of its nutritional needs domestically by 2030.

Singapore has positioned itself as a global leader in this space, thanks to its forward-thinking regulatory approach. In December 2020, it became the first country to approve the commercial sale of cultivated meat. The government has also backed this sector with substantial funding, including S$144 million allocated for alternative-protein research under the Singapore Food Story programme. Adding to this momentum is a robust ecosystem of over 60 alternative-protein companies, reflecting the nation’s dedication to advancing food innovation. Cultivated meat not only boosts local food production but also uses resources more efficiently, addressing concerns about sustainability.

This homegrown protein solution aligns seamlessly with Singapore’s goals of enhancing food security and promoting environmentally friendly practices. It’s a step towards a future where the nation can produce more of its own food without relying heavily on imports.